A new kind of economy is taking shape in Saudi Arabia. Inside its Special Economic Zones (SEZs), investors are finding streamlined systems, tax relief, and a business environment designed for growth.

As of April 2025, the Kingdom has introduced wide-ranging Special Economic Zone (SEZ) tax exemptions, updated regulatory frameworks, and cost-saving measures aimed at drawing global capital into sectors that reflect Saudi Arabia’s long-term ambitions. These moves aren’t just policy tweaks. They’re a statement of intent under Vision 2030.

Inside the SEZ Strategy: Built for Global Business

Saudi Arabia’s Special Economic Zones aren’t one-size-fits-all. Each zone has been strategically designed to serve a distinct sector, with tailored regulatory frameworks that support the industries most vital to the Kingdom’s economic transformation.

In April 2023, the government launched four new SEZs under the supervision of the Economic Cities and Special Zones Authority (ECZA):

- King Abdullah Economic City (KAEC) positions itself as a global logistics and light manufacturing hub, connecting trade routes along the Red Sea coast.

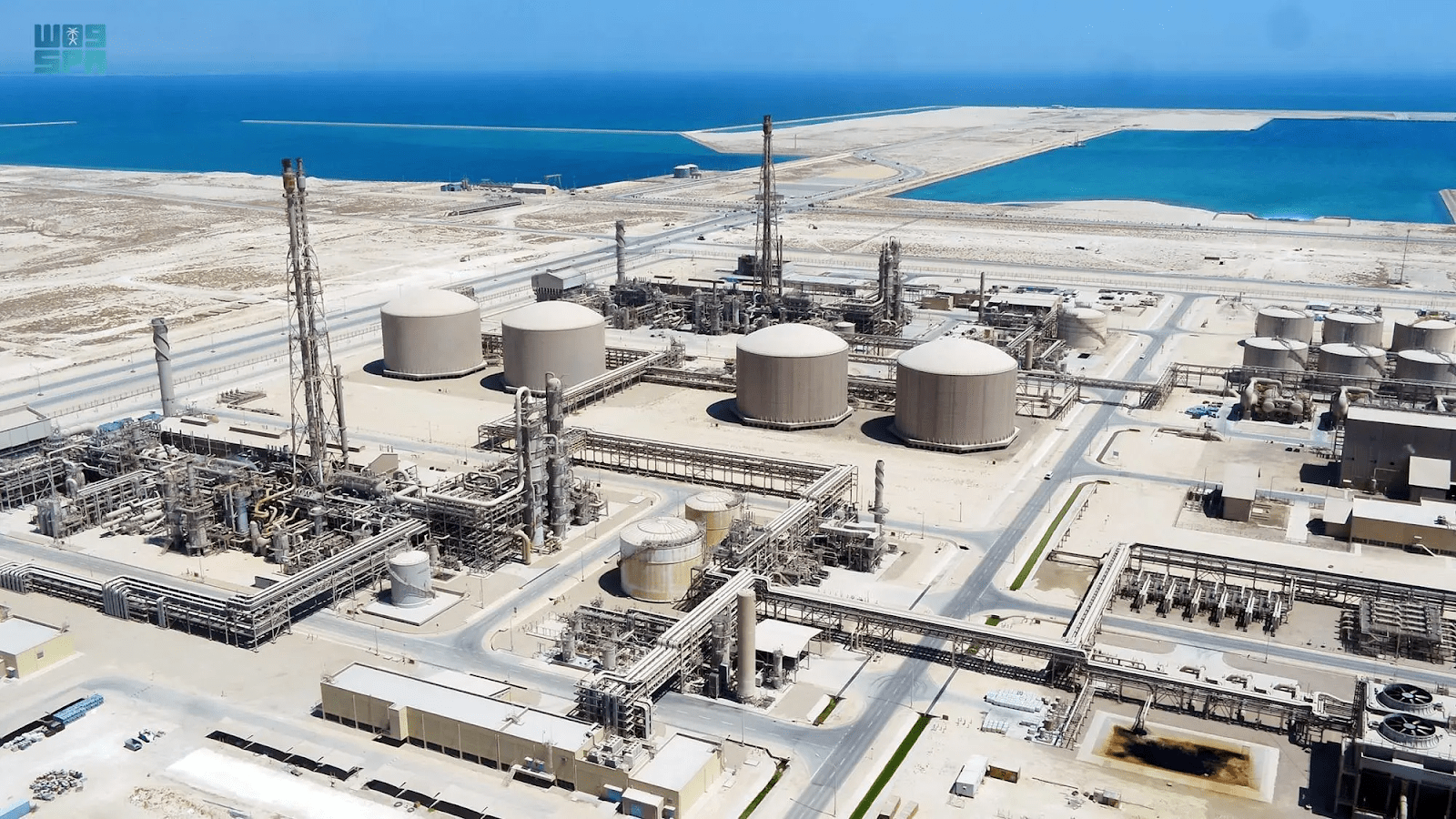

- Ras Al-Khair focuses on maritime industries and shipbuilding, using its strategic location on the Gulf to its advantage.

- Jazan SEZ drives food processing, heavy industries, and agriculture-linked manufacturing to serve both domestic and export markets.

- The Cloud Computing SEZ leads the development of digital infrastructure, data centers, and cloud-based technologies, powering the Kingdom’s digital economy.

These four zones complement the Special Integrated Logistics Zone (SILZ) near King Salman International Airport in Riyadh, which streamlines air freight and cargo operations for international logistics companies.

Each zone operates under its own regulatory and fiscal environment, offering reduced taxation, streamlined licensing, and relaxed labor policies. This structure allows businesses to operate outside the constraints of the broader Saudi economy, while still being fully integrated into its trade and investment ecosystem.

Corporate Tax at 5% or Less

Investors operating within these zones benefit from a 5% corporate income tax rate for up to 20 years. In some high-priority sectors, that rate drops to 0% for up to 30 years, giving long-term financial certainty to companies in technology, clean energy, and advanced manufacturing.

No Withholding Tax on Profit Transfers

Saudi Arabia has waived withholding taxes on profits repatriated by companies within SEZs. This allows international firms to move funds without additional tax burdens, an important advantage for multinationals managing global cash flow.

VAT? Not Here

Within the SEZs, businesses enjoy a 0% Value Added Tax (VAT) rate on goods supplied from within Saudi Arabia or between investors across the zones. Goods imported from outside the Kingdom are also excluded from VAT, provided they remain under customs suspension and serve the licensed activity of the investor.

These measures reduce overhead costs across supply chains, particularly for companies managing complex international logistics.

Customs Incentives and Equipment Imports

Saudi Arabia has introduced customs duty exemptions on capital equipment and production inputs used in SEZs. Any foreign goods entering from the main economy are treated as re-exports, and manufacturers benefit from deferred or eliminated customs duties.

This creates a leaner setup for companies requiring specialized machinery or imported components.

Labor Incentives That Attract Global Talent

SEZs also come with labor-related benefits. Companies are exempt from the usual expatriate levy, making it more affordable to bring in skilled foreign professionals.

New visa processes, streamlined residency applications, and exemptions on financial equivalence requirements were also introduced in 2025 through a multi-agency initiative. The focus of this campaign is to attract top-tier talent in fields like engineering, IT, and logistics.

Flexible Business Structures and Simplified Setup

Companies in SEZs can operate under a hybrid model that combines elements of limited liability and joint-stock companies. They can issue different classes of shares and benefit from more agile capital structuring.

Now, businesses can register, license, and access all relevant agencies digitally. This centralization removes unnecessary delays and supports faster decision-making.

International Arbitration and Business-Friendly Dispute Resolution

Saudi SEZs include dedicated arbitration and mediation centers, developed in partnership with the Saudi Center for Commercial Arbitration and the Ministry of Justice. These centers follow international standards, giving investors confidence in the legal and regulatory process.

Vision 2030 in Motion

Everything within the SEZ framework supports the larger national plan. Under Vision 2030, Saudi Arabia is transitioning from a petroleum-dependent economy to one built on diversified sectors.

Oil once made up more than 40% of GDP and 75% of fiscal revenue. Through foreign direct investment, the country is rebalancing its economy, and SEZs are helping to drive that shift.

Saudi Arabia’s Competitive Edge

Compared to other regional zones, Saudi Arabia’s SEZs offer a more complete package. From SEZ tax benefits and customs relief to talent attraction and dispute resolution, the offering is deeply integrated.

Investors also benefit from broader reforms like the new Investment Law of 2025, which simplifies procedures, allows 100% foreign ownership, and establishes eligibility criteria for incentives.

Saudi Arabia isn’t just offering relief from taxes. It’s providing a launchpad for long-term, scalable operations at the heart of a region with rising demand and a growing middle class.

A Business Environment That Moves With You

Saudi Arabia’s Special Economic Zone (SEZ) tax exemptions are part of a larger story. One of transformation, accessibility, and strategic growth. For global companies seeking stable markets, lower costs, and government-backed support, SEZs offer a powerful starting point.

These zones are reshaping the future of investment in the region, and with the right incentives in place, the door is open to businesses ready to grow.

FAQs

What are the SEZ tax benefits in Saudi Arabia?

Saudi Arabia offers 5% corporate tax, VAT exemptions, and customs relief for companies operating in Special Economic Zones.

How do Special Economic Zones (SEZ) tax exemptions support Vision 2030?

They encourage private sector growth, attract foreign investors, and diversify the economy beyond oil.

What types of businesses benefit from SEZ tax incentives?

Sectors like clean energy, manufacturing, logistics, cloud services, and advanced tech are eligible for long-term tax breaks.

Is there a tax on profit when transferred out of Saudi SEZs?

No. There’s a 0% withholding tax on profit repatriation for SEZ-based businesses.

Can foreign investors fully own companies in SEZs?

Yes. Saudi Arabia allows 100% foreign ownership in SEZs under the new investment regulations.