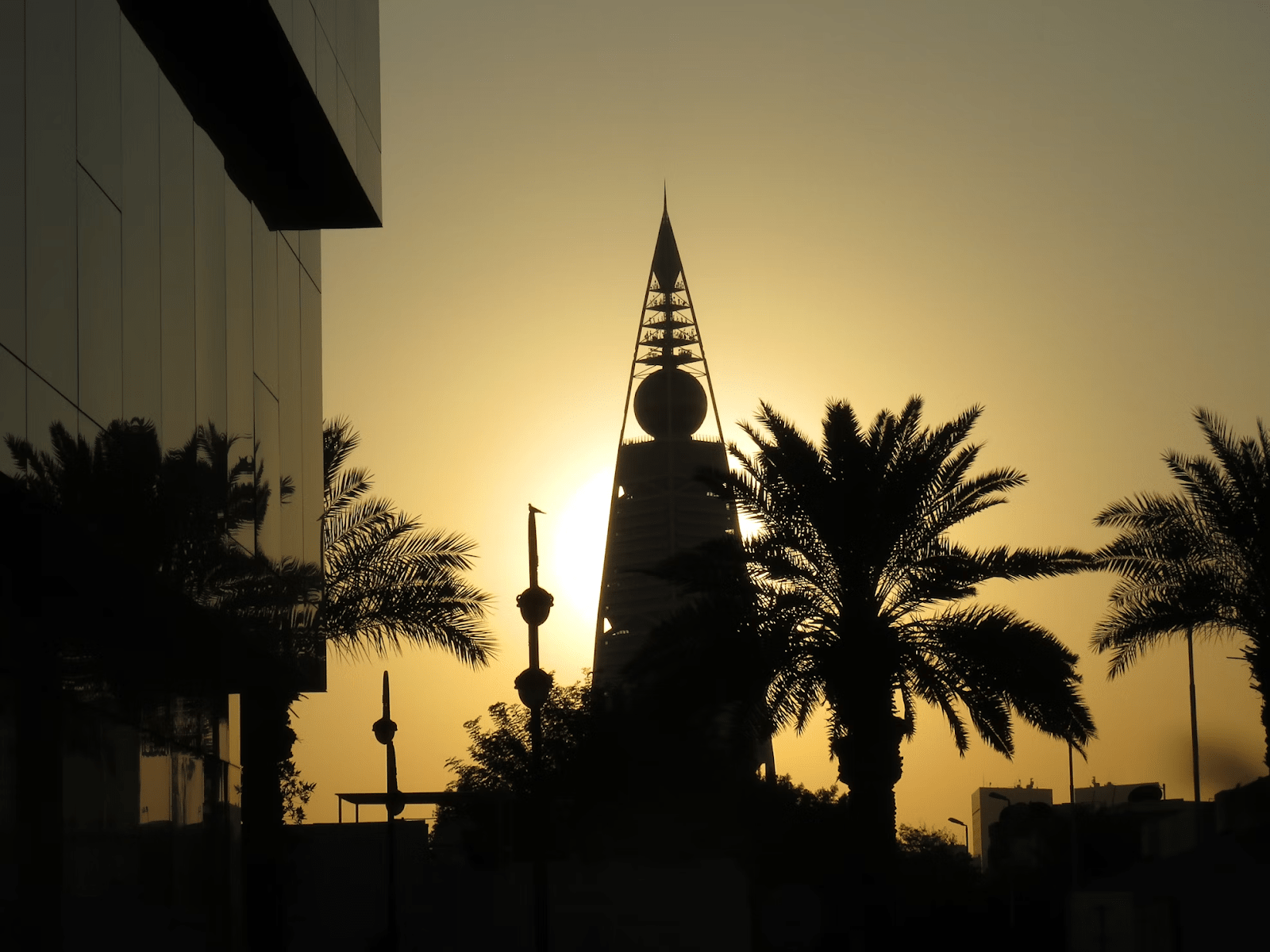

Riyadh’s skyline has always been a symbol of progress. An ever-evolving city that reflects Saudi Arabia’s ambitions. But amid its growth, a challenge quietly simmered: housing.

For many Saudis, the dream of owning a home felt like an impossible one, as land prices soared and rental costs climbed higher. Yet, in March 2025, the city found itself at the start of something transformative. Crown Prince Mohammed bin Salman unveiled sweeping real estate reforms aimed at calming the market and making homeownership easier for Saudi citizens.

The initiative addresses some of Riyadh’s biggest housing challenges: skyrocketing land prices, inflated rent, and a growing gap between supply and demand. As part of the plan, 81 square kilometers of land will be released for development. The reforms also introduce an affordable housing plan with up to 40,000 residential plots made available each year at capped prices.

These changes directly support Vision 2030, which aims to boost homeownership in Saudi Arabia to 70% by the end of the decade—up from 47% in 2016. With the construction sector seeing $7.9 billion in residential awards last year and the broader real estate market projected to reach $101.62 billion by 2029, these reforms come at a pivotal moment for Riyadh’s real estate market growth.

Land Reforms for a Balanced Future

In March 2025, the Crown Prince gave the green light to the Royal Commission for Riyadh City (RCRC) to reshape how land is used in the capital. This followed a detailed study from the Council of Economic and Development Affairs, which flagged extreme property price hikes as a serious concern for residents.

The land release focuses on two strategic northern areas:

- A 17-square-kilometer zone near King Khalid Road

- A 16.2-square-kilometer parcel north of King Salman Road

These areas were specifically chosen for their proximity to existing infrastructure and potential to ease pressure across the entire housing market. When combined with previously available land, the total developable area reaches 81.48 square kilometers, equivalent to about 11,400 football fields of new development potential. These reforms are poised to stabilize Riyadh’s real estate market, balancing supply and demand.

A Vision for Affordable Housing

At the core of these reforms is a clear goal: build more affordable housing for Saudi citizens. Between 10,000 and 40,000 plots will be released each year, with prices capped at SR1,500 per square meter (around $399.87). This move makes owning a home a real possibility for younger Saudis and married couples with no existing property.

Affordability Challenges: The average cost per square meter for residential properties in Riyadh’s real estate market ranges from SAR 3,000 to SAR 5,000. In upscale areas like Hittin and Al-Malqa, prices can soar between SAR 9,500 and SAR 13,500 per square meter. By capping plot prices at SR1,500 per square meter, the government aims to make housing more accessible to middle- and low-income families.

The government also put clear guardrails in place:

- 10-year restriction on selling, renting, or mortgaging

- Automatic reversion if land remains undeveloped

- Full refund for buyers if plots are reclaimed

Eligibility Details: The program prioritizes Saudi nationals who are first-time buyers, married individuals over 25, and government employees. Special financing options are available through partnerships with the Saudi Real Estate Refinance Company, which provides liquidity to the mortgage market.

Urban Development Backed by Vision 2030

Vision 2030 has an ambitious goal to bring Saudi Arabia’s homeownership rate to 70% by the end of the decade. To make that happen, the government is backing several initiatives. Among them are Sakani and Roshn, both focused on delivering affordable housing to lower- and middle-income citizens.

The demand is huge. To meet it, the government plans to build 115,000 homes every year until 2030. Much of that need is driven by a young population starting families and forming households. According to Knight Frank, 65% of future housing demand comes from household formation alone. The remaining 35% is driven by the government’s push to raise ownership rates.

Behind the scenes, strategic partnerships are accelerating progress:

- The National Housing Company’s deal with Egypt’s Talaat Moustafa Group for 27,000+ homes

- China’s CITIC Construction Group building industrial cities for construction materials

- Localization programs training Saudis for 250,000+ construction jobs

Flagship Projects Driving Riyadh’s Future

Major projects are bringing the long-term vision for Riyadh to life.

The NEOM project is perhaps the boldest of them all. It’s a planned mega-city focused on sustainability, high-tech living, and renewable energy. NEOM will rely on smart systems and green infrastructure to shape everyday life.

Just outside Riyadh, Qiddiya is another major development. It’s being built as a hub for entertainment, tourism, and business. The site will feature residential areas and leisure zones, opening the door to new investment opportunities.

Meanwhile, Roshn continues to focus on livable, community-oriented neighborhoods. These developments blend affordability with smart urban design. And they’re key to solving the city’s long-term housing needs, further shaping Riyadh’s real estate market.

Fixing the Supply-Demand Gap

One of the toughest challenges in Saudi Arabia’s real estate market has been balancing supply with demand. The new land release and housing initiatives are meant to fix that.

As more land becomes available, prices are expected to stabilize. Finance Minister Mohammed Al-Jadaan said these measures will help rein in rising property costs while keeping up with Riyadh’s growing population.

Another step is the White Land Tax, a 2.5% annual levy on undeveloped urban land. This tax pushes owners to develop or sell their land rather than hold it unused. It’s one more way the government is nudging the market toward healthier growth in Riyadh’s real estate market.

The Road Ahead

Of course, there are hurdles. Construction costs are rising. Labor supply is tight. And global geopolitical uncertainty adds pressure. But the government is investing in local capacity and infrastructure to keep projects on track.

Making sure these reforms reach everyone, especially middle- and lower-income Saudis, is a top priority. The eligibility restrictions and price caps are a start. But ongoing focus on equitable access will be key to long-term success in Riyadh’s real estate market.

Riyadh’s Housing Future Is Taking Shape

These reforms are a major leap toward transforming Riyadh into a global, livable capital. Crown Prince Mohammed bin Salman’s approach focuses on easing land prices, expanding affordable housing, and making it possible for more Saudis to own a home.

With the groundwork now laid, Riyadh’s real estate market is poised for a new chapter in urban growth—one that balances economic momentum with community well-being.

FAQs

When will Riyadh’s real estate reforms take effect?

Initial applications for the new plots are expected to begin in mid-2025. The full impact, including new developments, will become visible by 2027 as infrastructure and construction projects scale up.

Who is eligible for the affordable plots in Riyadh’s real estate market reforms?

Saudi nationals, particularly first-time buyers, married individuals over 25, and families without prior property ownership. Income thresholds and employment status (such as being a government employee) may influence priority access.

What’s the average cost of a plot under this plan?

Plots will be capped at SR1,500 per square meter, significantly lower than the market average, which ranges from SR3,000 to over SR13,000 depending on the area.

What happens if a plot isn’t developed within 10 years in Riyadh?

If undeveloped, the plot returns to the government. The buyer receives full reimbursement, ensuring land is used for genuine housing needs rather than speculation.

How do Riyadh’s real estate market reforms connect to Vision 2030?

These reforms are part of Saudi Arabia’s larger Vision 2030 agenda, which aims to increase homeownership to 70%, diversify the economy, and modernize urban development across the Kingdom.